One of the more common tasks you will do in Employee Self Service is review your paystub. Employees can view their paystubs using the OneUSG Connect Employee Self Service page. You will no longer receive an email when your paystub is available. On your pay date, you will be able to log in to OneUSG Connect to see your paystub.

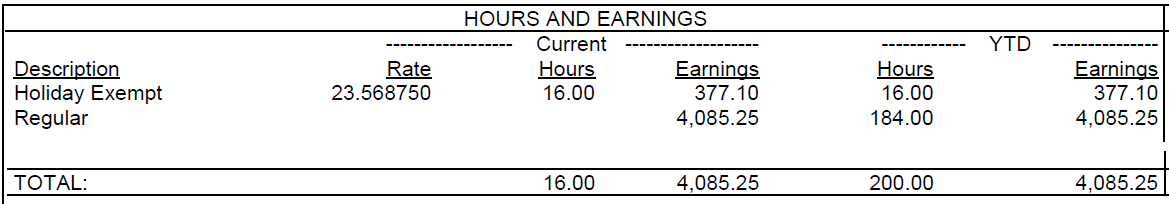

*Holiday hours are shown on monthly pay advice documents as information only. It will show the instances and value of those days. It is not Additional Pay. It is included in the monthly rate for monthly employees. (See image below for example.)

You may need to enable pop-ups in order to view your pay stub. To learn how to enable pop-ups in your browser, please refer to the Selecting a Browser, Clearing Cache, and Enabling Pop-ups job aid or the Enabling Pop-ups instructions.

Module Resources

Monthly Pay Advice Job Aid

In this article, you will view your pay stub.